Chinese leader Xi Jinping’s decision to stick with a zero-covid policy that worked in 2020 but has not stopped the spread of the Omicron variant has brought lockdowns in Shanghai, Shenzhen and Beijing among 45 mainland cities, affecting nearly 400 million people. The economic damage to China is now spilling over to U.S., Europe, Japan and others in a global economy struggling with shortages, inflation and the Ukraine conflict.

China’s Politburo promises stimulus, employment measures to boost COVID-hit economy

The ruling Chinese Communist Party (CCP) on Friday promised a slew of measures to help the country’s COVID-battered economy.

The CCP’s Politburo met on Friday to discuss economic growth, which is targeted to reach 5.5 percent this year, an unlikely target in the absence of further stimulus given the supply-chain havoc caused by the pandemic and risks linked to the war in Ukraine.

“The COVID-19 pandemic and the Ukraine crisis have led to increased risks and challenges, increasing the complexity, severity and uncertainty of our country’s economic development, and posing new challenges to stable growth, employment, and prices,” the meeting, chaired by CCP leader Xi Jinping, said in a communique summarized by state news agency Xinhua.

Beijing’s dynamic clearance, zero-COVID policy would continue, but measures would be taken to “keep the economy operating within a reasonable range,” the summary said.

Measures will include a boost to infrastructure construction and other stimuli to boost domestic demand and jobs, as well as tax rebates, tax and fee cuts and “monetary policy tools,” it said.

Measures should “stabilize and expand employment” and “maintain overall social stability,” as well as a national strategy to restore the country’s domestic supply chains and logistics industry, which has been left fragmented by COVID-19 restrictions in major cities and ports, particularly Shanghai.

Care should be taken to prevent rare and unexpected “black swan” incidents, as well as more predictable “gray rhino” developments from gathering momentum and getting out of hand, the report said, using buzzwords associated with Xi’s personal brand of political ideology.

Reuters quoted a person with knowledge of the matter as saying that the government would be meeting with internet platforms next month.

Outflow of foreign capital

Nomura’s chief China economist Ting Lu said he predicts an economic growth rate of just 1.8 percent in the second quarter of this year, with annual GDP growth of 3.9 percent for the whole of this year.

The move comes after a U.S.$8 billion selloff of Chinese government bonds by foreign investors in March, with foreign capital outflows of U.S.$17.5 billion in the same month.

Foreign investment in Chinese funds fell by 70 percent in the first quarter of 2022, compared with the previous quarter, while the yuan hit a six-month low against the dollar and China’s foreign exchange reserves fell by U.S.$25.8 billion between the end of February and the end of March.

Online comments were skeptical that the Politburo could do much to affect the mass outflow of foreign capital.

“The higher-ups shout their slogans, while the in-betweens have no policy to implement them, and the lower ranks are just cashing in,” according to one comment seen by RFA on Friday.

Others said little would change economically while the CCP’s zero-COVID policy was still in place.

The meeting came after the Wall Street Journal quoted a number of people as saying that Xi is insisting that China’s economic growth must exceed that of the U.S. this year. The U.S. posted a 5.7 percent GDP growth rate in 2021.

Downward revision

Zhu Chengzhi, chairman of Wanbao Investment Consulting, said said four percent GDP growth would be a good achievement for China this year.

“[Zero-COVID] must have caused a significant downward revision [in GDP growth forecasts], a very serious downward revision,” Zhu told RFA. “The real estate sector is stuck, and they’ll have to rely on money supply [to boost] domestic demand.”

“China’s economy is based on value-added manufacturing, but global prices for raw materials are on the rise around the world, squeezing profits in that sector, so that will also hurt GDP,” Zhu said.

In a commentary for RFA, commentator Wang Dan said recent moves by the CCP to regulate entire sectors of the economy by limiting private-sector involvement had affected the labor market, where 11 million new entrants are expected this year.

Wang said Xi will likely solve these structural problems by ordering up the results he wants to see.

“Why do I say he can still manage it? Because companies in China … do as he tells them,” he said. “This has to do with Xi Jinping’s status and his bid for [a third term] at the 20th party congress.”

He said the likelihood is that Xi regards his COVID-19 policy as a crucial part of attempts to demonstrate the superiority of China’s political system to the rest of the world.

“But if he elevates his disease control and prevention policy to be a part of that attempt, he will be forcing himself to ride a tiger,” Wang warned.

‘Common prosperity’

Zhu said stock markets in China, even pre-pandemic, had been dealt a huge blow by Xi’s insistence on the “common prosperity” model, which saw a nationwide ban on the highly lucrative private education and tutoring sector.

“During the past five years, mainland China and Hong Kong have been the only places where stockmarkets are falling, which is not a good sign,” Zhu said. “Xi Jinping is trying to introduce some bullish sentiment with certain remarks, but it’s just a brief respite.”

“It’s not so easy to correct mainland Chinese markets when they are this weak,” he said, adding that GDP figures are already likely artificially inflated, or shares would be performing better.

The meeting came as authorities in Beijing shut down more businesses and placed more residential compounds under lockdown on Friday, while extending contact-tracing.

Meanwhile, video clips of people banging pots and pans from Shanghai apartments in protest at the ongoing lockdown have been circulating on social media.

Translated and edited by Luisetta Mudie.

New 3nm ASIC Miners an Investment Opportunity

3nm ASIC Miner

NEW YORK, April 29, 2022 (GLOBE NEWSWIRE) — Bitramo, a recently launched blockchain startup, has opened up a solid invest opportunity for all crypto enthusiasts regardless of their knowledge or experience. Founded with the goal of making crypto mining super easy as well as profitable, the company has recently released its Ramo 1, Ramo 2, and Ramo X miners equipped with highly efficient 3nm ASIC chips.

Making profits by investing in crypto mining relies heavily on the hash rate and power consumption of the hardware used for mining. To ensure high profitability of its three miners, Bitramo offers hash rates that have not been found in any other mining hardware till date. Moreover, even though these rigs offer extraordinary computing power, they have reasonably low power consumption.

Hash Rates and Power Consumptions at a Glance

| Bitcoin | Litecoin | Ethereum | Monero | Power Consumption | |

| Ramo 1: | 360 TH/s | 30 GH/s | 2 GH/s | 2 MH/s | 550 W |

| Ramo 2: | 750 TH/s | 70 GH/s | 5 GH/s | 5 MH/s | 900 W |

| Ramo X: | 2250 TH/s | 210 GH/s | 15 GH/s | 15 MH/s | 2200 W |

High Profits and Superfast ROI

Owing to their high hash powers and moderate power consumptions, Ramo1, Ramo 2, and Ramo X miners are more profitable comparable to any other mining rig available on the market. Most importantly, users can fully recover their investment in less than a month.

Monthly profits one can make using these mining rigs are summarized below.

| Bitcoin | Litecoin | Ethereum | Monero | |

| Ramo 1: | $1900 | $1400 | $2200 | $2500 |

| Ramo 2: | $4000 | $3500 | $5700 | $6600 |

| Ramo X: | $12,300 | $10,500 | $17,000 | $20,000 |

Crypto Miners for Everyone

Another key advantage of Bitramo miners is their extraordinary ease of use. Unlike most other mining hardware available in the market, these products can be used without any prior experience or knowledge. Also, these miners have minimum system requirements, and can be run with an internet speed of just 10 KB/s. To simplify mining for the newbies, all Bitramo miners are delivered preconfigured with Linux based system equipped with Bitramo software.

The company also offers two years’ product warranty covering all types of software or hardware issues.

To find out more about this excellent investment opportunity, please visit https://bitramo.com/.

About Bitramo: A crypto mining startup backed by multiple corporations, Bitramo is on a mission to improve the crypto mining landscape by developing and delivering the latest technological innovations. The company offers an exquisite range of ASIC mining hardware designed to make crypto mining efficient and easy like never before. The company’s ultimate goal is to democratize crypto mining by allowing common people to benefit from it.

A photo accompanying this announcement is available at https://www.globenewswire.com/

Contact: Richard Blainey SEO Services Limited richard (at) backlinksguru.com

إحياء معرض كانتون العريق بفعاليات افتراضية

غوانزو، الصين، 29 أبريل 2022 / PRNewswire / — تم تنظيم 50 حدثًا ترويجيًا افتراضيًا ل “الجسر التجاري” لمطابقة الموردين والمشترين وتعزيز التجارة. تم عرض منتجات مختارة عالية الجودة على وسائل التواصل الاجتماعي من خلال أنشطة “اكتشف معرض كانتون مع Bee and Honey ” لتزويد المتابعين بتجربة تسوق غامرة. تم إرسال الملايين من رسائل البريد الإلكتروني المخصصة للدعوة إلى المشترين العاديين. وفقًا لمعرض كانتون، مع أنشطة الترويج المستهدفة، حققت هذه الدورة المزيد من النتائج للمشترين والموردين.

اكتسبت الأنشطة ذات الطابع الخاص التي يستضيفها Bee and Honey شعبية

استضافت جلسة Bee and Honey هذه، تمائم معرض كانتون التي تم تقديمها في البداية في دورته 130، العديد من البث المباشر على وسائل التواصل الاجتماعي. وقد ربطت أنشطة “اكتشف معرض كانتون مع Bee and Honey” ، وهي سلسلة من الأحداث الترويجية الافتراضية المبنية على “جولة Bee and Honey الافتراضية” في الدورة الماضية، الموردين بشكل فعال مع المشترين في الوقت الفعلي. اجتذب كل نشاط من الأنشطة الافتراضية الثمانية أكثر من 160,000 مشاهدة في جميع أنحاء العالم، مع ذروة بلغت أكثر من 200,000. تكشف الأرقام اللافتة للنظر عن الجاذبية الكبيرة لمعرض كانتون للمشترين العالميين.

التوفيق الفعال من خلال العروض الترويجية المستهدفة للتداول عبر الإنترنت

ووصلت أنشطة الترويج الافتراضية “الجسر التجاري” إلى 57 بلدًا ومنطقة. ولتحسين فعالية التفاعل، قامت هذه الجلسة بإعداد رائع استنادًا إلى الخبرة السابقة والتحقيق الشامل في احتياجات المشاركين. وتميز كل حدث بسوق مستهدف ومحتوى واسع النطاق ومهني وتغطية عالمية، مما سهل الاتصال النشط والناجح بين الموردين والمشترين. وفقا لإدارة الاتصالات الدولية في مركز التجارة الخارجية الصيني، قام موظفو معرض كانتون بالتحقيق الكامل في احتياجات الحاضرين وأرسلوا دعوات إلى جميع الوفود التجارية مقدمًا. خلال الأحداث، جعلوا من السهل على الموردين والمشترين الاتصال. كما قاموا بتتبع ملاحظات المشاركين وحل مشاكلهم بعد الأحداث.

ووفقًا لماغي بو، نائبة المدير العام لمكتب الشؤون الخارجية لمعرض كانتون، فإن النجاح المستمر للترويج للدورة عبر الإنترنت يعتمد على اعتراف العارضين والمشترين وثقتهم في معرض كانتون، المعرض رقم 1 في الصين. وبناء على النجاح الجديد، سيواصل المعرض تحسين الخدمات بتدابير وقدرات أفضل، مما يساهم بشكل أكبر في نمط التنمية الجديد الذي تغذيه التداولات المحلية والدولية.

قم بزيارة https://www.cantonfair.org.cn/

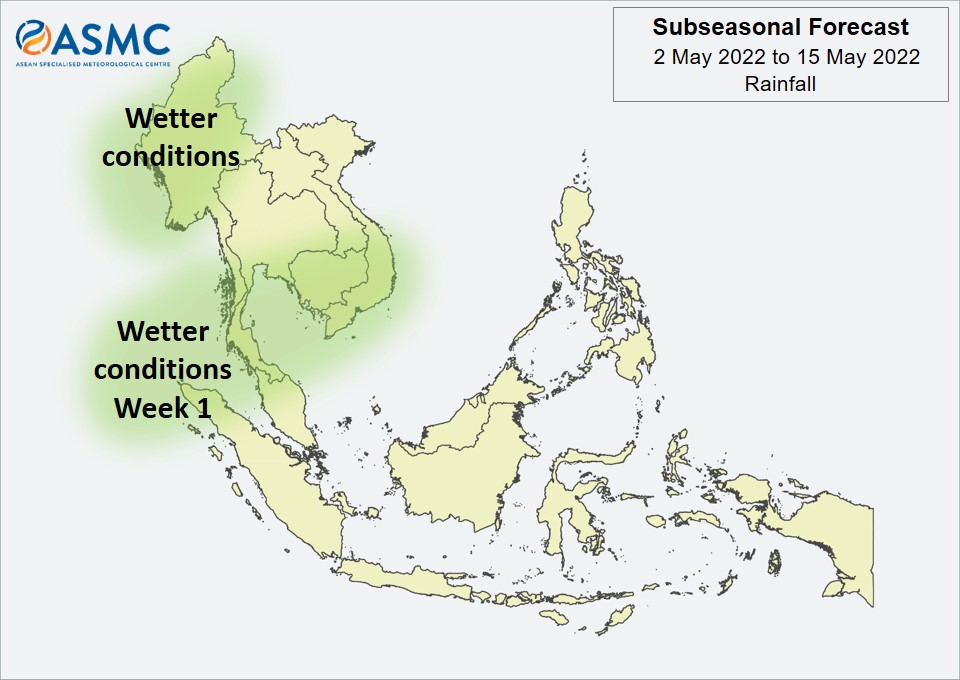

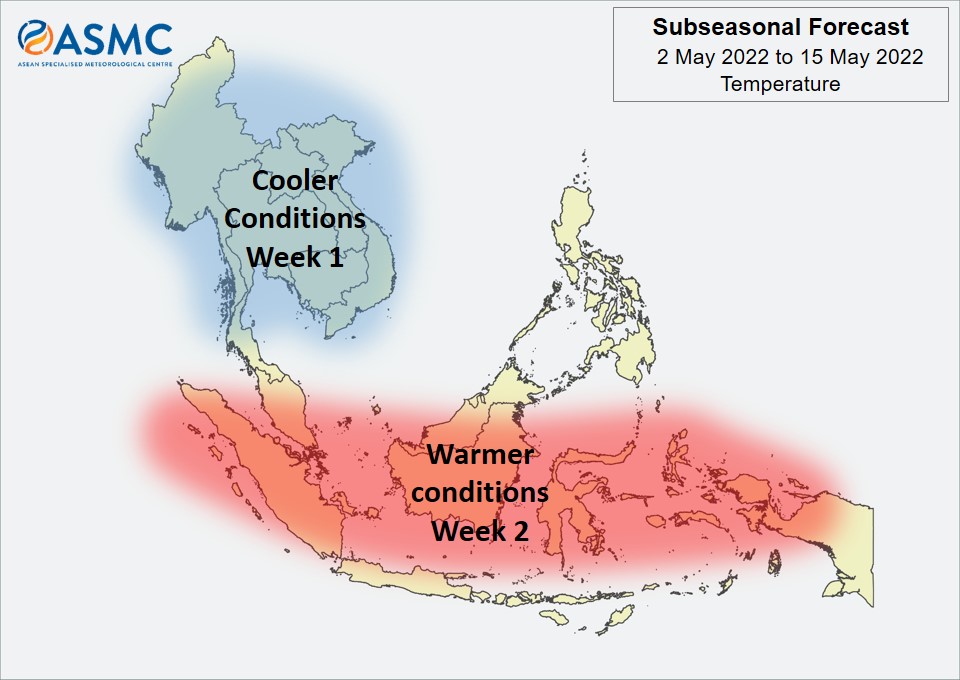

Subseasonal Weather Outlook (2 – 15 May 2022)

Subseasonal Weather Outlook (2 – 15 May 2022)

Issued: 29 April 2022

First forecast week: 2 May – 8 May

Second forecast week: 9 May – 15 May

Wetter conditions are expected over the northwestern part of the ASEAN region in Week 1 (2 May – 8 May), including Myanmar, southern Mainland Southeast Asia, and parts of the western Maritime Continent. These wetter conditions are predicted to ease in Week 2 (9 May – 15 May), apart from over most of Myanmar.

Cooler temperatures than usual are expected over most of Mainland Southeast Asia in Week 1 (2 May – 8 May). The highest likelihood for cooler temperatures is over eastern Mainland Southeast Asia. These cooler temperatures are predicted to ease in Week 2 (9 May – 15 May), except for parts of Myanmar, in line with the wetter conditions predicted.

Warmer than usual temperatures are predicted over the equatorial region in Week 2 (9 May – 15 May).

No discernible Madden-Julian Oscillation (MJO) signal was present at the end of April. Models predict the MJO signal to remain weak or indiscernible for the next fortnight.

The outlook is assessed for the region in general, where conditions are relative to the average conditions for the corresponding time of year. For specific updates on the national scale, the relevant ASEAN National Meteorological and Hydrological Services should be consulted.

Alert20220429 – Downgrade to Alert Level 2 for the Mekong Sub-Region

[unable to retrieve full-text content]

Downgrade to Alert Level 2 for the Mekong Sub-Region In recent days, increased shower activities were observed over the Mekong sub-region which have helped to alleviate the overall hotspot and smoke haze situation there. Parts of Myanmar, northern Lao PDR and northern Thailand may still experience continued hotspot and smoke haze activity during dry periods. […]